Confessions of a Receipt Hoarder

Let’s be real—until last tax season, my “filing system” was a literal shoebox (yes, ironic) spilling crumpled gas station receipts and coffee-stained invoices. My accountant’s horrified face during audit prep? Priceless. That’s when I discovered Shoeboxed. This wasn’t just another app; it felt like a financial intervention.

Why Your Ziploc Bags Full of Receipts Are Costing You Money

You think you’re saving deductible expenses. But can you:

- Instantly find that $42.78 printer ink receipt from July 2024?

- Prove IRS-accepted digital copies if audited?

- Calculate quarterly mileage deductions without a migraine?

Exactly. Paper receipts fade. Apps that force manual entry? Ain’t nobody got time for that. Here’s where Shoeboxed becomes your silent CFO.

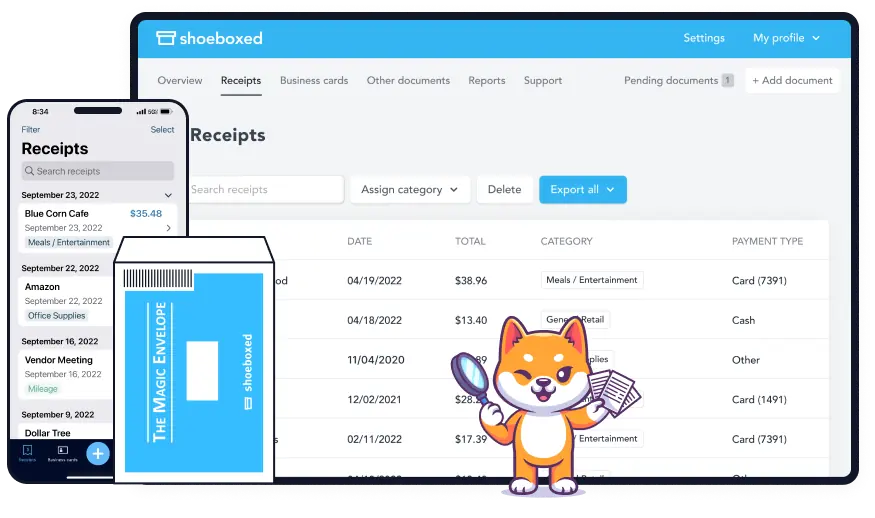

Magic in a Mailbox: The “Done-for-You” Scanning Secret

Shoeboxed’s killer feature? Their prepaid Magic Envelopes. I dump receipts into their envelope monthly (gas, lunches, supplies—even that sketchy parking lot fee). Their team:

- Scans both sides of every item

- Extracts key data: vendor, date, amount, payment method

- Categorizes automatically (Travel, Office, Meals)

- Stores IRS-accepted digital copies forever

No app matches this hands-off luxury. For $18/month (Starter Plan), I reclaimed 3+ hours/week.

Mobile App Superpowers: Turn Coffee Runs Into Deductions

While waiting for my latte:

- Snap a receipt → Shoeboxed’s AI reads it instantly

- Auto-sorts into custom categories (e.g., “Client Meetings”)

- Exports to QuickBooks/Xero with one tap

Real talk: The OCR accuracy stunned me. It even deciphered my dentist’s hieroglyphic handwriting.

Audit Armor: Why the IRS Loves This More Than You

During my last audit (thanks, home office deduction!), the agent said: “Shoeboxed? Good choice.” Here’s why:

- Digital copies are IRS-compliant (per Rev. Proc. 97-22)

- Timestamps & geotags prove legitimacy

- Exportable PDF reports with all transaction trails

I slept easy while my friend using “free apps” got $2k in disallowed deductions.

Shoeboxed vs. The “Free” Alternatives: A Brutal Reality Check

| Feature | Shoeboxed | Competitors (Expensify, etc.) |

|---|---|---|

| IRS Compliance | Certified digital copies accepted | User-generated photos often rejected |

| Data Extraction | Auto-categorizes line items | Manual entry required |

| Physical Receipts | Prepaid mail-in service included | You’re still stuffing envelopes |

| Search Function | Find “Staples receipt Aug 2024” in 2 secs | Scroll endlessly through blurry pics |

The Unsexy Feature That Saved My Marriage

My wife used to rage-quickbooks over unreimbursed expenses. With Shoeboxed’s shared envelopes:

- She snaps Target receipts → auto-syncs to our joint account

- I tag them “Household Reimbursables” → exports to Google Sheets

Our petty cash fights? Gone. Priceless.

Pro Tips From a 2-Year Shoeboxed Addict

- Tax Season Hack: Create a “2025 Deductibles” folder. Dump everything there → export to CSV for your accountant.

- Mileage Tracking: Snap gas receipts + use Shoeboxed’s trip logs = irrefutable deduction proof.

- Client Expenses: Tag receipts as “Client XYZ.” Bill them directly from exported data.

The Verdict: Ditch Your Shoebox (Literally)

Shoeboxed isn’t just software—it’s financial therapy. For solopreneurs drowning in paper trails or small teams tracking shared expenses, this is your ROI multiplier. At $29/month (Professional Plan), I’ve saved:

- $4,200 in maximized deductions last year

- 62 hours of receipt hell (yes, I tracked it)

- 1 near-divorce over a missing Uber receipt

🔑 Final Wisdom: Deductions don’t disappear—they’re lost in your junk drawer. Shoeboxed finds them.

Ready to turn receipt chaos into tax gold? → Try Shoeboxed FREE for 30 Days (No card needed. Seriously, do it before Q3 ends.)